What do the letters NDPE mean for your Valentine’s chocolate?

Article by Okita Miraningrum and Rita Raleira

How did you celebrate Valentine’s Day last week? Many chose to show their love and appreciation for their loved ones by offering them the typical gifts of the season – flowers, candy, or… chocolate! Besides being an all-time favorite Valentine’s Day gift, many people also consume chocolate daily — be it as a chocolate bar or as an added product in milk, morning cereals, cookies, or many others. But, considering the prevalence of chocolate on this (and other) special days, maybe it deserves to be looked at more closely. What lies behind (and inside) our favorite chocolate treats is not always obvious, nor are the possible implications of its production and consumption.

Chocolate trends at a glance

Europe dominates the industrial chocolate market, leading in chocolate production, exports, and consumption. According to available public data, in 2020, 3.6 million tonnes of chocolate products were produced in the European Union (EU), mostly in Germany, Italy, and Belgium. As for chocolate products exports, Germany again leads the EU group, with 16% global market share in value, followed by Belgium (11%), Italy (7.6%), Poland (7.2%), and the Netherlands (6.5%). Consumption shows the same trend: with an estimated average chocolate consumption of 5 kg per capita per year, Europe places well above the world’s average of 0.9 kg per capita per year. Germany, Switzerland, and Estonia are the Top 3 European countries in chocolate consumption, with 11 kg, 9.7 kg, and 8.8 kg per capita per year, respectively.

However, even though Europeans are large producers and avid consumers of chocolate, key raw materials that go into its production are grown elsewhere in the world. A good example of this is cocoa beans, but so is palm oil. Although it is not associated with chocolate by default, palm oil has become an important component of chocolate and the EU imports large quantities of it. In 2021, almost 6 million metric tons of palm oil entered the EU market, 91% of which were supplied by only five countries – Indonesia (45%), Malaysia (25%), Guatemala (9%), Papua New Guinea (7%), and Honduras (5%). And, interestingly, the same four EU countries were among the Top 5 importers of palm oil and cocoa beans in 2021 – Netherlands, Germany, Italy, and Belgium.

Chocolate production and supply chain

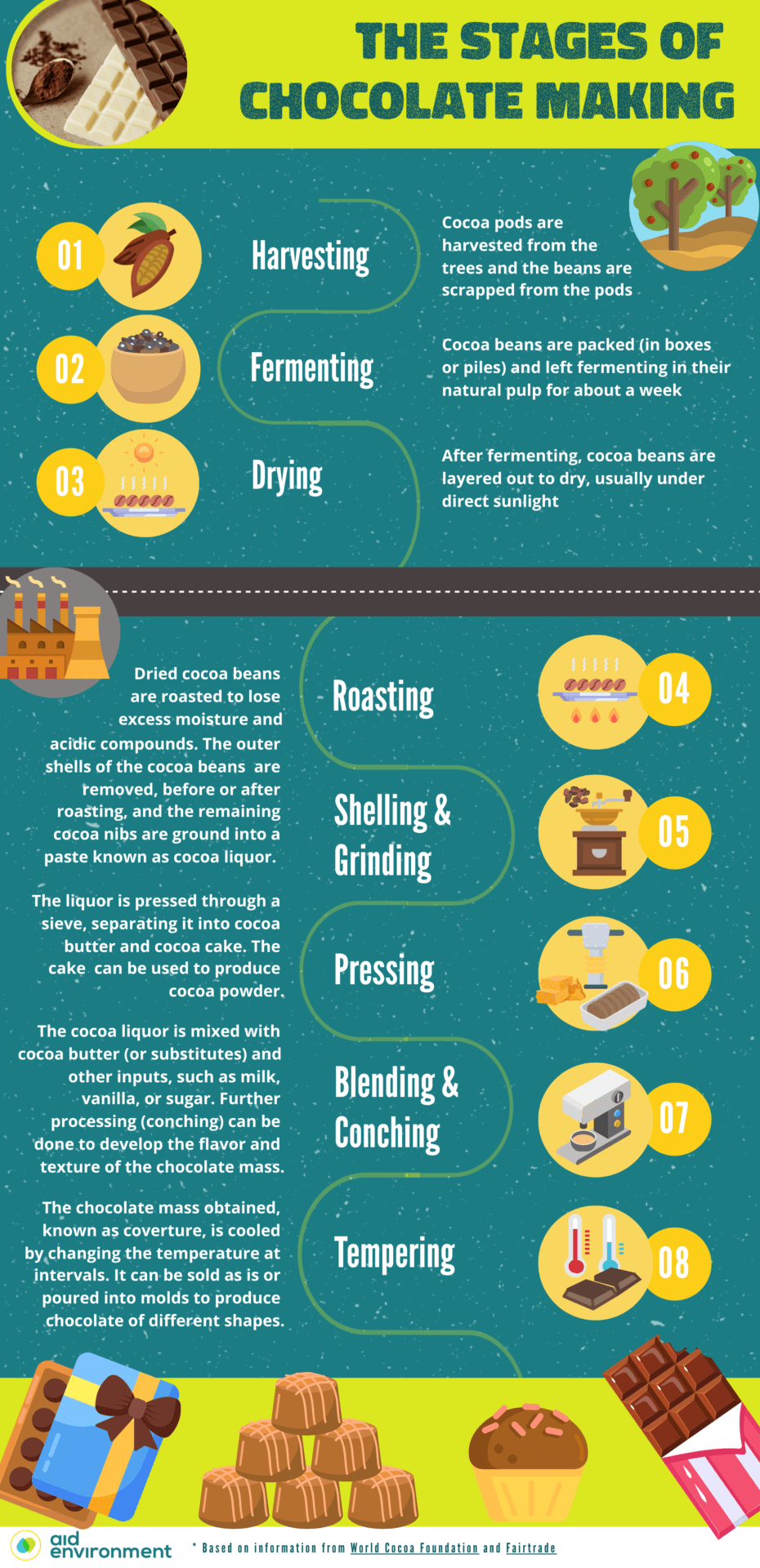

The base of any chocolate product is a fruit called cocoa, which is grown in Latin America, Southeast Asia, and, most of all, in West Africa, in countries such as Côte d’ Ivoire, Ghana, and Cameroon. Cocoa trees, usually grown by smallholder farmers, do best in areas with a hot and humid atmosphere, and abundant rainfall. From crop to consumer, cocoa goes through a series of processes in a complex supply chain, from the harvesting farms to the processing and manufacturing units that transform cocoa beans into paste, powder, butter, and all kinds of solid products, such as chocolate bars and pralines.

But making chocolate takes more than just cocoa beans. Fats, for instance, are an essential component of chocolate-based products since they are responsible for creating its glossy, chewy, and stable texture. Cocoa butter can be used for this purpose, but it is often considered too expensive. Therefore, many chocolate producers opt for substitute products, known as Cocoa Butter Alternatives (CBAs), which are largely produced from vegetable oil, including palm oil. One of the most popular CBAs thanks to its lower price, neutral taste, and versatility, palm oil can be mixed with cocoa liquor and provides good melting properties and a longer shelf life for chocolate products.

Palm oil production and sustainability

Oil palm trees also need to be grown in areas with steady amounts of rain and sunshine. Indonesia and Malaysia are the biggest producers of palm oil in the world. According to the Food and Agriculture Organization (FAO), the two countries together were responsible for 84% of the world’s total palm oil production in 2020. Indonesia and Malaysia are also largely covered by tropical rainforest, which started to shrink due to the expansion of oil palm plantations. In Indonesia, oil palm plantations were a significant driver of deforestation in the 1990s and 2000s, affecting a highly biologically-diverse ecosystem and natural carbon storage. In 2008-2009, 40% of the deforestation in Indonesia was attributed to palm oil, which caused a heated debate and prompted protest actions from many parties, such as environmental NGOs, civil society organizations (CSOs), and climate activists.

The ‘brand shaming’ strategy was used to highlight the role of consumer goods companies in particular. Such strong pressure induced the birth of the first zero-deforestation policies by palm oil companies in 2013. These zero deforestation policies, known as No Deforestation, No Peat Development, and No Exploitation (NDPE) commitments, were introduced initially by the giant palm oil company Wilmar, which other upstream and downstream companies followed suit.

NDPE policies encapsulate a mandate to engage with and/or eliminate suppliers and activities that may endanger forests and peatlands. These policies also determine that companies must increase their transparency and disclosure practices by, for instance, publishing and maintaining an up-to-date list of their mill suppliers and establishing a grievance system. This level of transparency has helped increase the accountability of relevant parties.

The role of the Roundtable on Sustainable Palm Oil (RSPO), a voluntary sustainable palm oil certification body, has also been an important element in increasing palm oil’s sustainability. RSPO elevated the sustainable palm oil discourse and practice by establishing that growers with non-compliant clearings after November 2007 bear a higher liability to compensate, while any clearings that took place after May 2014 may cause suspension from RSPO membership. One of the identified drivers of the adoption of NDPE policies by companies has been the RSPO’s requirement on the inclusion of a zero-deforestation commitment in their sustainability policies. Furthermore, as demand for sustainable palm oil increases, more and more companies are pursuing RSPO certification and procuring RSPO-certified palm oil.

Increasing initiatives in palm oil sustainability have transformed and improved the sector. Chain Reaction Research (CRR) reported that, between 2018-2021, deforestation within oil palm concessions decreased and reached its lowest in 2021, when “none of the 10 largest deforesters [could be] conclusively linked to the NDPE market”.

These positive developments raise hope, although not without caution. To some extent, it can be stated that NDPE policies have yielded good results and helped distinguish between compliant and non-compliant palm oil producers. However, deforestation persists among a group of repeating offenders, which indicates that relevant ‘leakage’ markets still accommodate non-compliant producers. Moreover, research by CRR found that some big palm oil companies operating under NDPE policies have ‘shadow’ companies which continue to engage in forest clearing activities. These ‘shadow’ companies operate without NDPE commitments and are not being officially acknowledged as part of the main companies’ operation.

So, what’s next for our Valentine’s Day chocolate?

It is crucial to ensure deforestation-free, sustainable production, transparent supply chains, and access to product information. Hopefully, just like we see in palm oil, more and more stakeholders will develop, support, and commit to policies similar to NDPE while more far-reaching supply- and demand-side approaches are adopted and improved. Among others, the upcoming EU Regulation on deforestation-free products provides a good example of the type of regulatory actions that can be taken to address sustainability issues such as commodity-driven forest loss. Palm oil and cocoa are two out of the seven commodities covered by this Regulation which prohibits companies from placing a group of selected raw materials and derived products in the EU market if they are produced on recently deforested land. Although it should not be seen as a silver bullet given its limitations, the EU Regulation is nonetheless a step in the right direction when it comes to increasing transparency and accountability while incentivizing more sustainable systems of production and supply.

Such efforts have made some positive changes, and we can keep the ball rolling. There is more room to improve how we source and produce Valentine’s chocolate, among others, for more sustainable celebrations in the years to come.