Timber Deforestation by Alas Kusuma Demonstrates Continued Exposure of Palm Oil Buyers

Introduction

The take-up of No Deforestation, No Peat, No Exploitation (NDPE) policies by the palm oil industry has had a significant impact on reducing forest loss for oil palm plantation development. A 2020 study by Aidenvironment and our partners determined that 83% of refining capacity in Indonesia and Malaysia, accounting for approximately 50% of the world’s refining capacity, is covered by NDPE sourcing policies. Our internal analysis shows approximately 75% of all oil palm growers are compliant with NDPE policies.

However successful the application of NDPE policies by palm oil buyers has been, they have fallen short in one key area. NDPE policies apply only to the palm oil sector. Deforestation committed for other crops, even if that deforestation is committed by a company in a palm oil supply chain, is typically considered outside the scope of the NDPE policy.

It is common for companies in Indonesia and Malaysia to operate in multiple sectors. Out of the 10 largest oil palm growers in Indonesia, six are involved in mining. In Indonesia, 64% of all industrial forest plantation permits (the permit typically used to develop pulp and paper concessions) are held by company groups that also operate oil palm concessions. In the Malaysian state of Sarawak, the six largest companies in oil palm plantation development are estimated to hold 69% of Sarawak’s industrial forest plantation concessions.

AidEnvironment published a report in 2021 that identified ten companies that deforested over 133,000 ha between 2016 and 2020 for the development of industrial forest plantations. These ten companies also operate oil palm concessions. In Indonesia, these included Nusantara Fiber, Djarum, Adindo Hutani Lestari, Jhonlin, Hardaya, Sampoerna, and Alas Kusuma. In Malaysia, it included Rimbunan Hijau, Samling and Shin Yang. All these plantation companies have supply chain links to one or more of the world’s largest palm oil refiners.

AidEnvironment has advocated for the application of NDPE policies at a company-wide level, not at commodity level, so that companies actively deforesting cannot access NDPE-covered supply chains simply because the deforestation is not for oil palm. However, this approach has met significant resistance from key palm oil buyers.

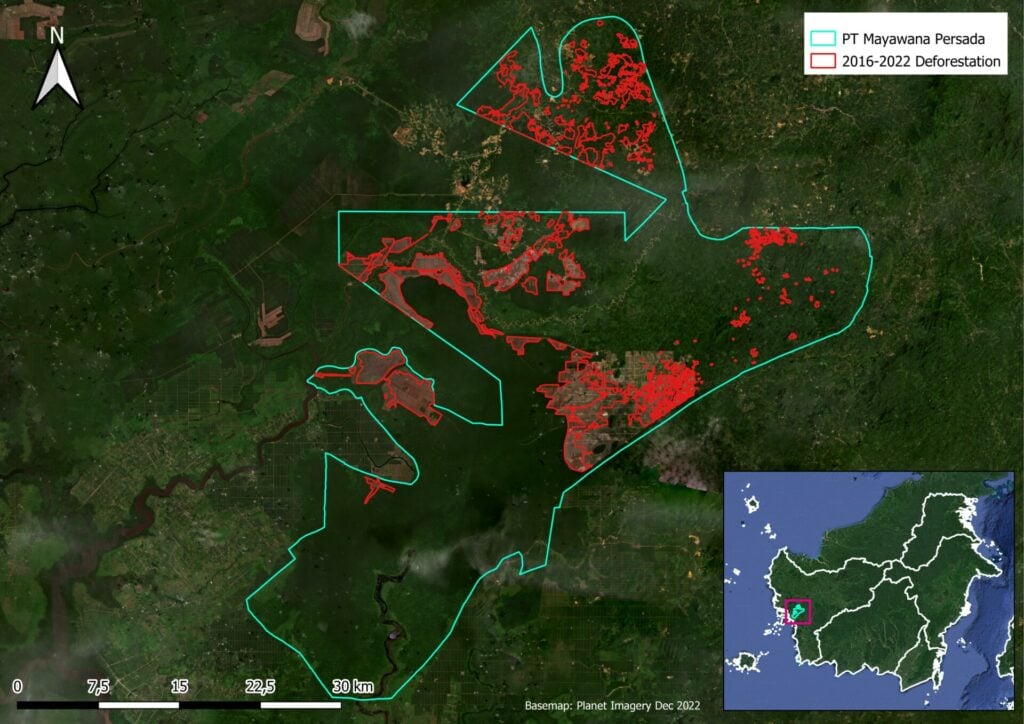

Since 2020, AidEnvironment has been monitoring the activities of PT Mayawana Persada in West Kalimantan. There has been continuing deforestation on this industrial forest plantation, which is operated by the Indonesian company Alas Kusuma. The largest deforester of any industrial concession in Indonesia, the company is likely accessing NDPE-covered palm oil supply chains.

Alas Kusuma

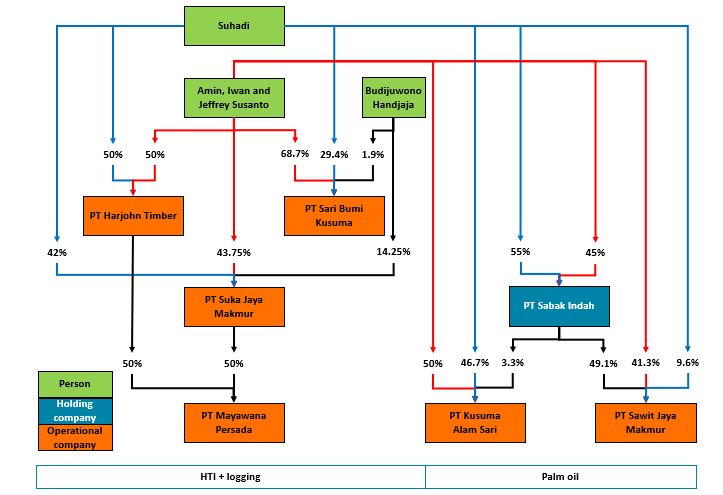

Alas Kusuma manages one industrial tree concession company (PT Mayawana Persada), three integrated logging and timber processing companies (PT Sari Bumi Kusuma, PT Harjohn Timber, and PT Suka Jaya Makmur), and two oil palm concessions (PT Kusuma Alam Sari and PT Sawit Jaya Makmur). Analysis by AidEnvironment has revealed that PT Mayawana Persada, their industrial forest plantation, cleared around 20,000 ha of forest between 2016 and 2022.

According to the notary acts, the individuals associated with Alas Kusuma include Amin Susanto, Jeffrey Susanto, Iwan Susanto, Suhadi, and Budijuwono Handjaja. Interestingly, with the exception of Jeffrey Susanto, all these names are documented in the Panama Papers, suggesting a connection to a shell company registered in British Virgin Island known as First Asset Enterprises Limited.

Figure 1 Alas Kusuma’s Ownership Chart, before January 2023

In January 2023, PT Mayawana Persada underwent a change in ownership, with half of its shares acquired by a Malaysian company known as Green Ascend (M) Sdn Bhd. Notably, the corporate information of Green Ascend (M) Sdn Bhd indicates that certain individuals associated with company are also involved in the management of Acapalm Plantation Services Sdn Bhd, which oversees the plantation management for Nusantara Fiber.

Alas Kusuma’s Timber Businesses

Alas Kusuma operates four timber businesses, which are summarized in the table below. Three of the companies are Forest Stewardship Council (FSC) certified.

Table 1: Timber Business Operations by Alas Kusuma

| Company | Business Operation | Forest Stewardship Council (FSC)-Certified | Type of Certification | |

| 1. | PT Harjohn Timber | Logging and timber processing | Yes | Chain of Custody (CoC) |

| 2. | PT Sari Bumi Kusuma | Logging and timber processing | Yes | Chain of Custody (CoC), Forest Management (FM) |

| 3. | PT Suka Jaya Makmur | Logging and timber processing | Yes | Forest Management (FM) |

| 4. | PT Mayawana Persada | Industrial forest plantation | No | – |

FSC certification is a voluntary scheme within the timber industry, aimed at ensuring that timber is sourced sustainably across supply chains. FSC issues three types of certifications, each tailored to various stages of timber production:

- Forest Management (FM) Certification: This is issued for forest concessions, confirming that the forest is managed sustainably, preserving biodiversity, and benefitting local communities.

- Chain of Custody (CoC) Certification: Specifically aimed at wood processing companies, the CoC certification verifies the origin of forest-based materials throughout the production process. Its objective is to guarantee that sourced materials are separated from “unacceptable material” while adhering to the FSC standard. This is confirmed through a comprehensive due diligence process, as stipulated by the CoC Standard. This stipulates that organizations are permitted to source non-FSC certified materials classified as “controlled material”, provided they meet certain requirements. Among these requirements is a fundamental condition: controlled material can only be used when it is fully complying with the FSC standard.

- Controlled Wood (CW) Certification: This is designed to separate unacceptable materials by mixing them with FSC-certified wood, typically labelled as “FSC mix products”. This certification plays a crucial role in ensuring that materials used meet acceptable sustainable criteria, even if they are not fully FSC-certified.

Alas Kusuma’s Deforestation on PT Mayawana Persada

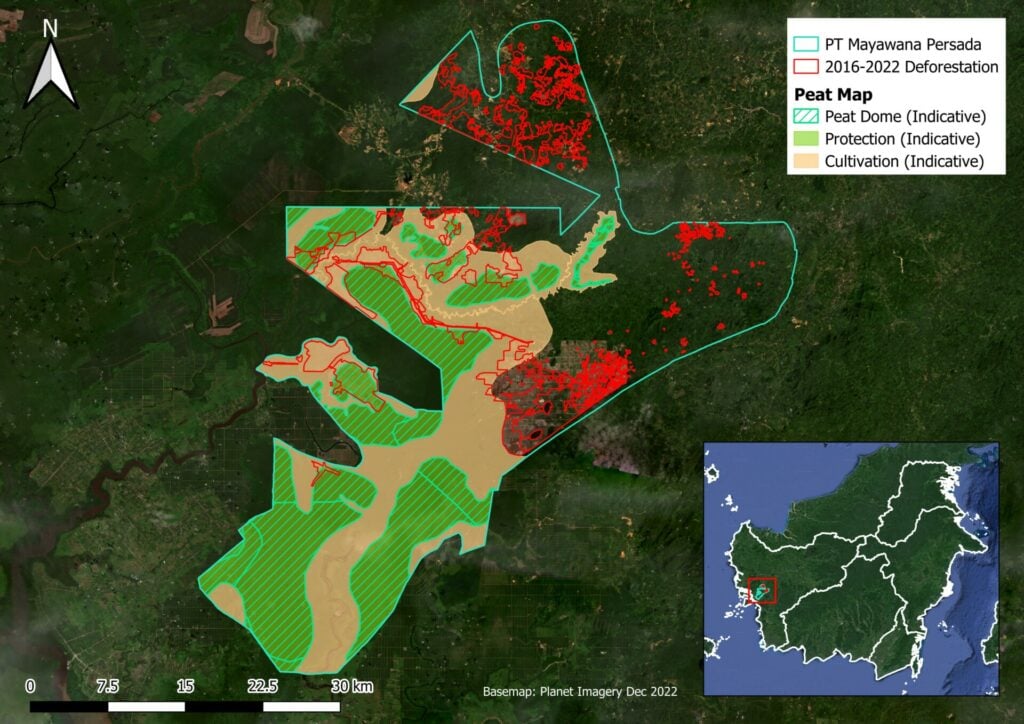

PT Mayawana Persada is an industrial forest plantation situated in the Ketapang and North Kayong Districts in West Kalimantan. Within the concessions boundaries lies critical orangutan habitat and valuable peatland, officially mapped by the Indonesian Ministry of Environment and Forestry (Table 2). As shown in table 2, over 60% of the concessions total area is officially recognised as orangutan habitat and is therefore of high conservation importance.

Table 2: Overview of PT Mayawana Persada’s Concession

| Category | Total area (ha) | Percentage of concession area |

| Concession area | 138,710 | 100% |

| Orangutan habitat, as published by the Ministry of Environment and Forestry | 89,410 | 64.4% |

| Peatland, as published by the Indonesian Ministry of Environment and Forestry | 83,060 | 59.9% |

| Forest in 2016, as mapped by the Indonesian Ministry of Environment and Forestry | 88,100 | 63.5% |

Alas Kusuma has cleared a significant portion of the forest within PT Mayawana Persada in the last few years. Table 3 provides a summary of the deforestation figures within this concession between 2016 and 2023. There has been a significant increase in annual deforestation since 2021, a significant portion of which is occurring within orangutan habitat.

Table 3: Deforestation by PT Mayawana Persada in 2016 to 2022

| Year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | Total (2016-2022) |

| Deforestation | 186 | 518 | 345 | 2281 | 1569 | 3034 | 12107 | 20039 |

| Deforestation within peat | 0 | 0 | 0 | 15 | 0 | 269 | 7031 | 7315 |

| Deforestation within orangutan habitat (PHVA) | 131 | 354 | 246 | 1840 | 1194 | 2695 | 9183 | 15643 |

Figure 2: PT Mayawana Persada’s Deforestation, 2016-2022

Despite being registered as a legal entity under Indonesia’s Ministry of Law and Human Rights since 1994, PT Mayawana Persada began clearing operations in 2019. Initially, PT Mayawana Persada functioned as a joint venture between PT Inhutani III (a state-owned enterprise) and Alas Kusuma. However, since 2006, it has been wholly managed by Alas Kusuma.

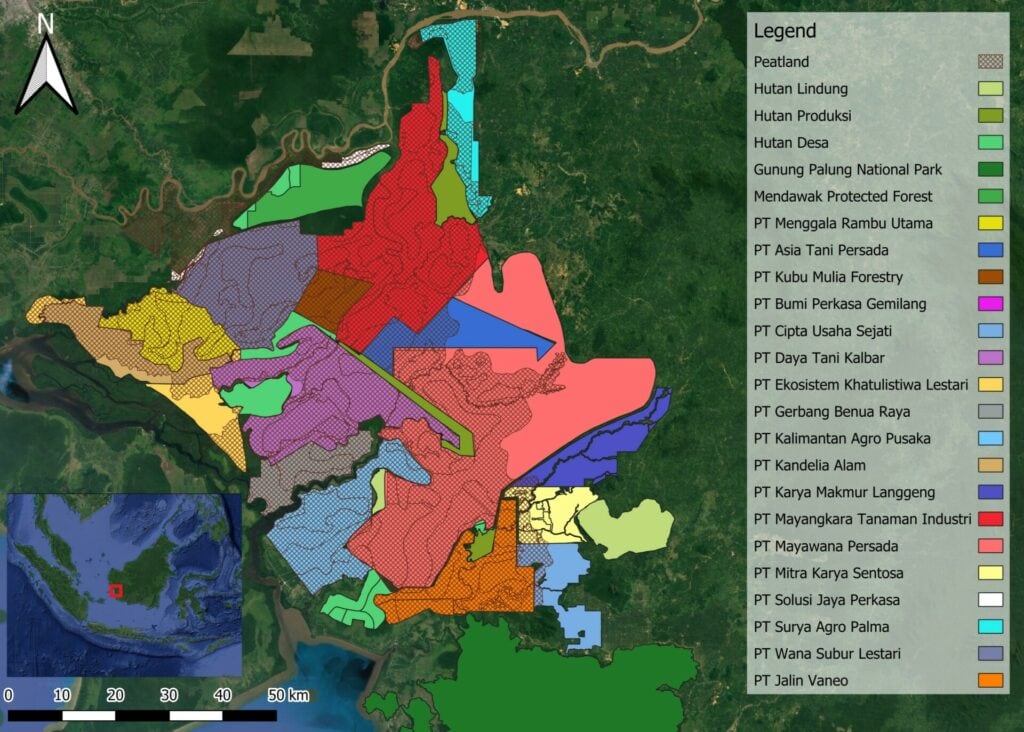

Figure 3: Mendawak Landscape

The deforestation activities within PT Mayawana Persada have gained attention for several reasons. In 2016, more than half of the concession area was still covered in forest, making it a critical part of the remaining forested orangutan habitat not only within the larger landscape, coined Mendawak (Figure 3), but also across West Kalimantan. The concession itself is larger than Gunung Palung National Park, an area home to almost 3,000 orangutans. Within the concession-dominated landscape of Mendawak, PT Mayawana Persada has the most remaining forested orangutan habitat, and also covers significant peatland areas, as depicted in figure 4 below.

Figure 4: Peatland Distribution Within PT Mayawana Persada’s Concession

In 2021, Mongabay reached out to Alas Kusuma in a request for comments regarding alleged deforestation within PT Mayawana Persada. In a media response, a representative from Alas Kusuma stated that the company had followed recommendations following an analysis of orangutan distribution and a high conservation value (HCV) assessment conducted by a third party. However, due to the absence of the HCV document in the HCV Resource Network database, the public remains unable to access the document and verify these claims.

It is crucial to note that the deforestation activities undertaken by PT Mayawana Persada should be considered a violation of the Policy for Association by FSC. In 2022, PT Mayawana Persada supplied its timber to several companies, including PT Harjohn Timber, PT Basirih Industrial, PT Wijaya Tri Utama Plywood, PT Putra Kalimantan Sukses, and PT Indonesia Fibreboard Industry. Further analysis of trade data by AidEnvironment in 2021 revealed that these companies supplied to various Japanese companies (see table 4).

Table 4: Potential Buyers of PT Mayawana Persada in Japan, 2021

| Companies | Japanese Buyers (2021) |

| PT Basirih Industrial | Itochu Kenzai, SMB Kenzai, Nippon Paper Lumber Co Ltd, Sojitz Building Material Corporation. |

| PT Wijaya Triutama Plywood Industri | Yuasa Trading Co Ltd, Japan Kenzai Co Ltd, Noda Corporation, Sia Trading Inc, YNK Corporation. |

| PT Indonesia Fibreboard Industry | SMB Kenzai Co Ltd, Noda Corporation. |

| PT Harjohn Timber | Daiken Corporation, Itochu Kenzai Corporation, Noda, Omni Tusda, SMB Kenzai, Sumitomo Forestry, Yuasa Lumber |

Notably, PT Harjohn Timber exported its products internationally to countries like Japan and the United States. Among its Japanese importers, Sumitomo Forestry Co Limited ranked highest, with a recorded total of 6,600 tonnes of net weight imported between January and September 2021. Another significant importer of Harjohn Timber’s plywood is Itochu Kenzai Corporation, which imported 1,400 tonnes of net weight plywood during the same period. Itochu has stringent NDPE policies in place which also cover timber sourcing.

Alas Kusuma’s Palm Oil Businesses

Alas Kusuma owns two oil palm concessions, namely PT Kusuma Alam Sari and PT Sawit Jaya Makmur, located in West Kalimantan. These concessions, however, are not associated with any palm oil mills, making it challenging for AidEnvironment to establish a direct link between these concessions and buyers that have NDPE policies in place. Nonetheless, because fresh fruit bunches (FFB) from oil palm concessions must usually be processed within 24 hours to maintain the quality of the harvested fruits, any mills within 50 km radius of these concessions could potentially be buyers of oil palm produced by Alas Kusuma’s plantations.

Table 5 provides an overview of mills situated in close proximity to PT Kusuma Alam Sari and PT Sawit Jaya Makmur, outlining their NDPE policy status, and their responses regarding any potential connections with Alas Kusuma’s palm oil business operations.

Table 5: Potential Buyers of Alas Kusuma’s Palm Oil

| Mill | Group Company | Known NDPE Policies | Response |

| PT Graha Agro Nusantara | KPN | Yes | No response, but highly possible it buys FFB from Alas Kusuma |

| PT Bumi Perkasa Gemilang | Tunas Baru Lampung | No* | No response, but highly possible it buys FFB from Alas Kusuma |

| PT Cipta Tumbuh Berbuah | – | – | Not yet able to establish a communication |

| PT Pundi Lahan Khatulistiwa | – | – | No response, but highly possible it buys FFB from Alas Kusuma |

| PT Saban Sawit Subur | Djarum/HPI Agro | Yes** | The company confirms it does not buy from the two concessions |

| PT Surya Borneo Indah | – | – | Not yet able to establish a communication |

*Tunas Baru Lampung has a sustainability commitment mentioning that the company’s operations follow sustainability principles as described in the Indonesia Sustainable Palm Oil (ISPO) standard.

**HPI Agro does not publish its NDPE policies on the website, but in a letter to AidEnvironment, the group company says that its operation follows the NDPE principles.

In 2021, investigations by an Indonesian NGO found that Pundi Lahan Khatulistiwa bought fresh fruit bunches from Alas Kusuma’s PT Kusuma Alam Sari. However, direct communication with PT Pundi Lahan Khatulistiwa has not been established, making it impossible to confirm whether FFB from PT Kusuma Alam Sari are still being supplied to PT Pundi Lahan Khatulistiwa.

Additionally, AidEnvironment obtained private information indicating that Alas Kusuma supplies FFB to KPN’s PT Graha Agro Nusantara and Tunas Baru Lampung’s PT Bumi Perkasa Gemilang. Despite efforts to contact both parties for confirmation, no response has been received as of this report being written.

It is not uncommon for palm oil from concessions without mills to enter NDPE supply chains unwittingly. In November 2022, the palm oil company Bumitama issued a statement clarifying its commitment to its NDPE policy. The statement came after it was revealed that a non-compliant supplier, PT Permata Sawit Mandiri, had entered Bumitama’s supply chain. FFB from PT Permata Sawit Mandiri entered Bumitama’s Bukit Belaban Jaya mill in West Kalimantan. The Indonesian palm oil refiner Goodhope also purchased FFB from PT Permata Sawit Mandiri, telling AidEnvironment in January 2022 that they had immediately suspended purchases when alerted to PT Permata Sawit Mandiri’s deforestation.

As of September 2023, Pundi Lahan Khatulistiwa enters NDPE supply chains through various companies, including Archer Daniels Midland (ADM), BASF, Cargill, Grupo Bimbo, Innospec, KAO, Kellogg’s, and Wilmar. KPN has similarly entered NDPE supply chains through connections with Avon, BASF, Bunge, Cofco, Danone, Fuji Oil, HSA/Pacific Inter-Link, Innospec, Kellogg’s, Mondelez, Olam, Pepsico, PZ Cussons, P&G, Unilever, and Vandemoortele. Tunas Baru Lampung, who used to supply to NDPE market, has faced scrutiny due to peat clearing activities, leading many companies committed to NDPE standards to discontinue their purchases from the company. Presently, Tunas Baru Lampung appears in the supply chains of Avon, Danone, Fuji Oil, Grupo Bimbo, Innospec, Kellogg’s, and Mondelez. With the exception of Fuji Oil, none of the aforementioned buyers operate as traders.

Alas Kusuma Potentially Entering NDPE-Covered Supply Chains

Alas Kusuma’s deforestation activities on PT Mayawana Persada mean it is not a company that can claim to be deforestation-free. However, there is a risk that palm oil that originates from concessions managed by Alas Kusuma is entering NDPE supply chains through untransparent FFB supplies. Palm oil buyers associated with mills included in Table 5 should immediately engage their suppliers to ensure that palm oil from Alas Kusuma is not entering their NDPE-covered supply chains.

There is precedent for palm oil buyers taking action against companies with a deforestation risk on industrial forest concessions. In 2020, the Malaysian company United Malacca planned to clear a densely forested area in Central Sulawesi for the purpose of establishing an industrial forest plantation. Although the development was for timber, palm oil buyers with NDPE policies engaged with United Malacca and warned them that development of the concession would violate NDPE policy commitments. In response to mounting pressure from its palm oil buyers, United Malacca decided to temporarily put the development on hold until a HCV assessment could be conducted. As of 2023, a stop-work order remained in effect, and the concession has still not been developed. Buyers exposed to Alas Kusuma’s deforestation should show a similar level of NDPE policy commitment.