EUDR Application: Trade Flows and Key Operators Supplying Relevant Products

Article drafted by Sarah Drost and Rita Raleira.

With the EU Deforestation Regulation (EUDR) having entered into force in June this year, preparations for the application of the law have been set in motion. EU Member States must nominate their respective Competent Authorities, responsible for the supervision and enforcement of the EUDR, by the end of 2023, while the European Commission must set up an Information System (described in Art. 33 of the law). Among other functionalities, this system will serve as a registration platform for operators and traders that are placing relevant products under the EUDR in the EU market. This will allow for the European Commission, as well as Competent Authorities and other relevant governmental agencies in different EU Member States, to have an overview on the companies to which the EUDR applies. However, at the moment, the pool of companies that will be subject to the requirements of the EUDR is not fully known and it is not likely that the European Commission will make this information publicly available.

AidEnvironment has been working on this front, analyzing trade flows of deforestation-risk products covered by the EUDR that originate from non-EU countries and are placed in the EU market.

In collaboration with our partners, such as ClientEarth and Meridian Institute, we have identified key importing operators in the EU and large exporting traders in the countries of origin of soy, cattle (beef and leather), palm oil, cocoa, and rubber products, linking them to the EU Member States where the imported volumes are delivered. Some of the countries of origin from which products have been traced are Argentina (beef), Brazil (beef, leather, and soy), Indonesia (rubber and palm oil), and Côte d’Ivoire (cocoa). As for the EU countries of destination, the most relevant ones are the Netherlands, Germany, Spain, and Italy, which are the top-5 recipient EU countries for at least seven out of the ten products analysed.

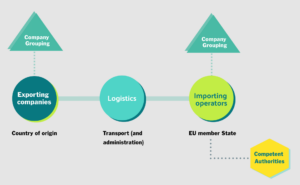

Identifying these flows and specifically the companies that are exporting to and/or importing these products in the EU market demanded a close look at the corporate structures of the companies at stake. It is not unusual to see subsidiaries/affiliates of a parent company engaging in trade exchanges in their own capacity without involving the name of the parent company.

Nonetheless, to have an overview of the total volumes of a given commodity/product that are traded by a parent company, the volumes traded by subsidiary companies must also be accounted for. Additionally, it is highly relevant to understand where these cargoes are landing in the EU to understand the oversight capacity Competent Authorities will need to have to appropriately oversee compliance and enforce the regulation on the operators/traders placing relevant products in the EU market through their respective Member States.

Having an overview of the current trade inflows and the companies involved has allowed AidEnvironment to further expand its understanding of the landscape of application of the EUDR.

For more information, please contact Sarah Drost or Rita Raleira.